Information Central

Taxes

Cities are constitutionally and statutorily authorized to levy and collect taxes for the purpose of general operating revenues. While specific types of taxation are somewhat dependent on classification, a city can impose taxation and fees on:

1. Stock used for breeding purposes

2. Franchises, trades, occupations, and professions

3. Personal property

4. Other ad valorem taxes

These funds are generally used to pay for most governmental services such as police protection or ambulance services, but in some instances – e.g., tourism taxes – the use of tax money is restricted.

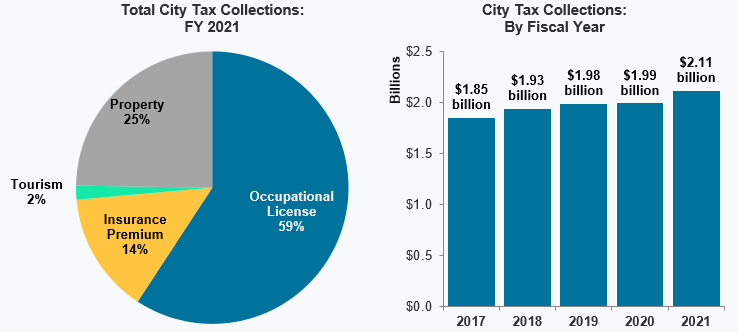

Kentucky cities may not levy income or sales taxes; therefore, they must depend on revenues generated from licenses and property. Occupational and business license taxes, insurance premium taxes, and property taxes are usually the most important revenue sources for cities.

Larger cities in Kentucky heavily depend on occupational license taxes – particularly on payroll and business net profits – for more than half of their revenue. Cities with tourism commissions can also have a motel tax (transient room tax) for tourism purposes, and former fourth and fifth class cities may also levy a tax on restaurant sales.